Private Limited Company Registration

Registration

Compliance & Operations

Start Your

Grow With US

We FinAccy Business Solutions LLP, your trusted consultant/ advisor, will help you in incorporating a private limited company in a quick, cost-effective and hassle-free way. From the day one after taking up the work we take care of all the formalities and fulfil the compliances, as defined by the Ministry of Corporate Affairs (MCA).”

What is Private Limited Company Registration?

As per Section 2(68) of The Companies Act 2013,”private company” means a company having a minimum paid-up share capital as may be prescribed, and which by its articles –

(i) restricts the right to transfer its shares;

(ii) except in case of One Person Company, limits the number of its members to two hundred:

Provided that where two or more persons hold one or more shares in a company jointly, they shall, for the purposes of this clause, be treated as a single member:

Provided further that—

(A) persons who are in the employment of the company; and

(B) persons who, having been formerly in the employment of the company, were members of the company while in that employment and have continued to be members after the employment ceased, shall not be included in the number of members; and

(iii) prohibits any invitation to the public to subscribe for any securities of the company.”

Further as per Section 3 of The Companies Act 2013 minimum two persons will be required for creating a private limited company.

Benefits of Incorporation of Private Limited Company:

Incorporating a Private Limited brings many benefits also. A great benefit is that a registered business entity increases authenticity and reliability towards your business.

- No minimum paid up share capital required for incorporating a private limited company there is no need of minimum paid up capital

- Separate Legal Entity Company and its members will be treated separately. Assets and liability of company will be assets and liability of company. Company can sue others and it can be sued by others.

- Limited Liability as Liability of members of a private limited company will be limited to the amount they own towards their shareholdings

- Perpetual Succession mean members of a company may come and go but a company can go on forever

- Preferred by Banks and financial institutions Normally private limited companies are preferred by banks and financial institutions as it is a registered entity

- Easy to raise additional capital A private limited company can not raise capital from public but it can raise capital by preferential allotment

Requirements for Online Company Registration

As such there is no requirement for incorporating a private limited company except an irony will of starting a business. You just need to simply call or email on our phone no. or email id respectively.

For registration of private limited company id proof and address proof will be required. Following documents is accepted by MCA for incorporating company online.

A Unique Name

For registering a company first thing you will require is a unique name. So just think a name or we will help in figuring out the name too.

Identity and Address Proof

- Scanned copy of PAN card or passport (foreign nationals & NRIs)

- Scanned copy of voter ID/passport/driving license

- Scanned copy of the latest bank statement/telephone or mobile bill/electricity or gas bill

- Scanned passport-sized photograph specimen signature (blank document with signature [directors only)

Registered Office Proof

- Scanned copy of the latest bank statement/telephone or mobile bill/electricity or gas bill

- Scanned copy of notarised rental agreement in English

- Scanned copy of no-objection certificate from the property owner

- Scanned copy of sale deed/property deed in English (in case of owned property)

Latest Passport Size Photo

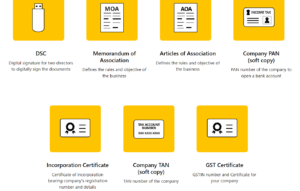

What will you get from us?

We will provide you everything that is required for running a company in India.

Clients Testimonials

Trustindex verifies that the original source of the review is Google. I am very happyTrustindex verifies that the original source of the review is Google. Very good experience with Finaccy business solutions LLPTrustindex verifies that the original source of the review is Google. I had a good experienceTrustindex verifies that the original source of the review is Google. Very good work experienceTrustindex verifies that the original source of the review is Google. This firm has been an exceptional partner in managing our business finances. Their team is knowledgeable, professional, and always up to date with the latest tax regulations. What I appreciate most is their personalized approach. Their attention to detail, responsiveness, and transparency in pricing have been invaluable. We now feel confident in our financial future, thanks to their expert guidance. Highly recommended for any accounting needs!Trustindex verifies that the original source of the review is Google. Excellent experience with him. Right solution on right time.

Explore Private Limited Company

How much time is needed for setting up a private limited company in India?

Do I need to be physically present during this process?

No, company formation in India is a fully online process. As all documents are filed electronically, you would not need to be physically present at all. You would need to send us scanned copies of all the required documents & forms.

Is it necessary to have a company’s books audited?

Yes, a private limited company must hire an auditor, no matter what its revenues are. In fact, an auditor must be appointed within 30 days of incorporation. Compliance is important with a private limited company, given that penalties for non-compliance can run into lakhs of rupees and even lead to the blacklisting of directors.

Are two directors necessary for registration of a company?

Yes, a minimum of two directors are needed for a private limited company. The maximum members can be 200. You can register as a one person company, if you are the sole owner of the company.

What is the minimum capital needed to do company incorporation?

There is no minimum capital required for starting a private limited company.

Can the director of a private limited company be a salaried person?

Yes, a salaried person can become the director in a private limited, LLP or OPC private limited company. One needs to check the employment agreement if that allows for such provisions. In a lot of cases, the employers are quite comfortable with the fact that their employee is a director in another company.

Can the limited liability partnership (LLP) be converted to a private limited company?

No, one cannot convert an LLP into a private limited company as it is not a MCA. The Limited Liability Partnership Act, 2008 and the Companies Act, 2013, both don’t have any provisions on conversion of the LLP in a private limited company. However, if one wants to expand their business they can register a new private limited company with the same name. The LLP company needs to just issue a no objection certificate.